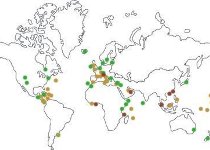

list of offshore financial centres (ofc)

low tax jurisdictions of the world

This

list of offshore financial centres includes countries

officially considered as tax havens by the OECD and all

jurisdictions that offer tax incentives

similar in nature. It also includes those territories where

the characteristics of the legal or banking system are

directly related to offshore business.

This

list of offshore financial centres includes countries

officially considered as tax havens by the OECD and all

jurisdictions that offer tax incentives

similar in nature. It also includes those territories where

the characteristics of the legal or banking system are

directly related to offshore business.

List of offshore financial centres

| Alderney | Gibraltar | Nauru |

| Andorra | Grenada | Netherlands Antilles |

| Anguilla | Guatemala | Niue |

| Antigua and Barbuda | Guernesey | Norfolk |

| Aruba | Hong Kong | Oman |

| Antillas Holandesas | Ireland | Panama |

| Aruba | Israel | Philippines |

| Bahamas | Jersey | St. Kitts and Nevis |

| Bahrain | Jordan | St. Vincent |

| Barbados | Labuan | St. Lucia |

| Belize | Lebanon | Samoa |

| Bermuda | Liberia | San Marino |

| Botswana | Liechtenstein | Sark |

| British Virgin Islands | Luxembourg | Seychelles |

| Brunei Darussalam | Macau | Singapore |

| Cayman Islands | Madeira | Switzerland |

| Campione D'Italia | Malta | Turks and Caicos |

| Cook Islands | Isle of Man | UAE |

| Costa Rica | Marshall Islands | United Kingdom |

| Cyprus | Mauritius | Uruguay |

| Dominica | Monaco | USA |

| Ghana | Montserrat | Vanuatu |

The list of offshore financial centers (OFC) is very broad and extends throughout the world, although the level of legal and tax implications is not the same in all cases.

Return from "list of offshore financial centres" to home page...